What is a Short Term Loan?

There are many different types of loans out there which serve different purposes to every client. However, sometimes it’s hard to know which is which. So what is a short term loan? How do they work, and how is it different from any other small loan or payday loan? We have put together some common questions and will share everything you need to know about short term loans in Australia.

Overview:

- What is the purpose of a short term loan?

- What are short term loans used for?

- Can you get a short term loan with bad credit?

- Do short term loans improve credit ratings?

- How much can you borrow on a short term loan?

- What is the easiest type of short term financing?

- Can I apply for more than one short term loan?

- Is a long term or a short term loan better?

What is the purpose of a short term loan?

The purpose of a short term loan is to offer a loan to someone who needs a little extra cash for difficult or unexpected payments. Short term loans can be an easy way to take out a quick loan and be able to pay it back within a 12 month period.

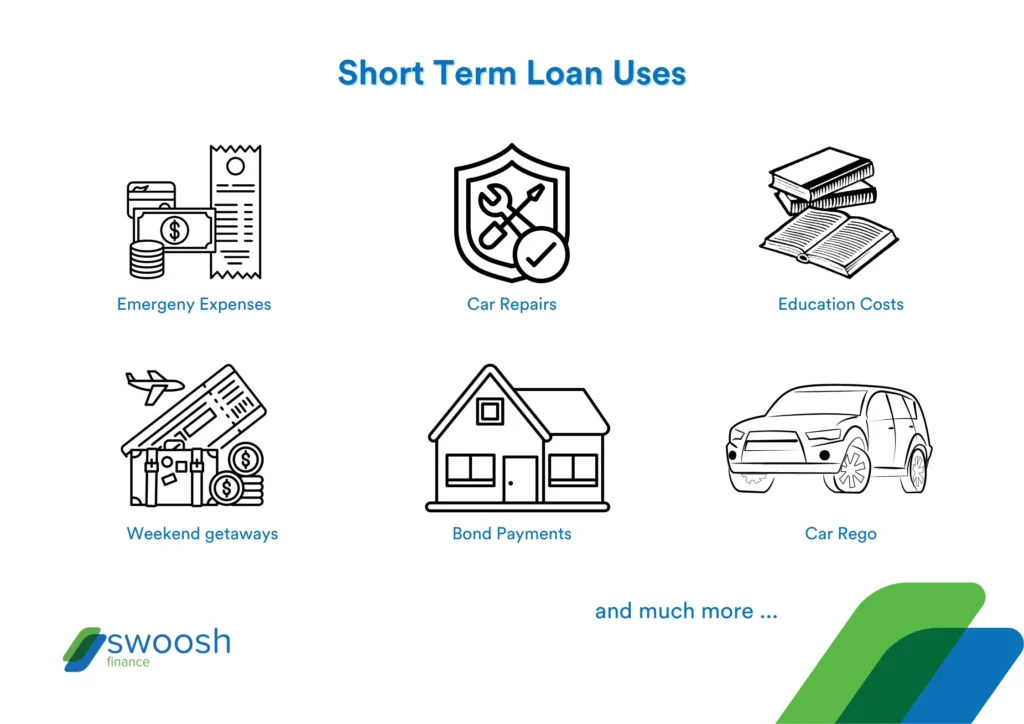

What are short term loans used for?

Short term loans can be used for a variety of reasons, including:

Can you get a short term loan with bad credit?

It is possible to get a short term loan with bad credit, but it can make it more challenging and the loan terms may be less favourable. Lenders who provide loans to borrowers with bad credit typically charge higher interest rates to mitigate any risk. It’s a good idea to shop around, compare offers and ensure that you can comfortably afford repayments before taking out any loan.

Need a loan but concerned about bad credit? At Swoosh, we focus on your current financial situation, not your past history! Apply online today.

Do short term loans improve credit ratings?

Similar to most loans from lenders, short term loans can improve your credit rating depending how you manage the loan. For a short term loan to have a positive impact on your credit rating, it’s important to keep up-to-date with your loan repayments and openly communicate any financial difficulties with a lender.

How much can you borrow on a short term loan?

Considering this is a short term loan with a short term repayment plan, the amount you can borrow is a smaller amount. It will also depend on the lender you choose as to how much you can borrow as each lender has their own unique terms and conditions.

At Swoosh you can borrow anywhere from $2,200 to $5,000. Get started on your loan application today!

Do short term loans have higher interest rates?

Yes, short term loans have higher interest rates compared to other types of loans which have longer repayment periods. However, overall, the total cost of borrowing is typically lower than a long term loan due to the shorter repayment period of a short term loan.

What is the easiest type of short term financing?

The easiest type of short term financing is ultimately your decision as there are multiple different types and they each have their own criteria and repayment methods. We have put a list together of some of the most common types of short term financing options:

| Buy Now, Pay Later | Buy now, Pay later loans such as Afterpay and Zip allow you to buy the products from most stores immediately. Then you have time to pay back the money, usually it’s around 4 to 6 weeks. |

| Credit Cards | Credit cards allow you to have an extra card that will help you pay for everyday items, with 30 days to repay the amount you spent. After the 30 days interest will begin to accrue with the leftover payment amount. |

| Payday Loans | Payday loans are designed to help you through to the next paycheck, these loans have a fixed repayment period. |

| Unsecured Personal Loans | An unsecured loan means no asset is used as collateral. However, this could mean the loan has higher interest rates, more uncertainty and you will receive a smaller amount by the lender. |

| Secured Personal Loans | A loan guaranteed by securing an asset, lenders use an asset as security so you and the lender have a safety net. These loans tend to be faster, easier and allow you to borrow more money. |

| Short Term Loans | Loans that are repaid in a 12 month period, used for a variety of different purposes and allows you to have flexibility with the use of the loan for expenses. |

Can I apply for more than one short term loan?

It is possible to apply for more than one loan at the same time. That said, there are a few things to consider beforehand:

- Can you afford the repayments of multiple loans?

- How will your credit score be affected with that many loans at once?

- Will the lender you choose allow you to have multiple active loans at once?

Is a long term or a short term loan better?

Which loan type is right for you will depend on your individual circumstances. A short term loan offers a smaller amount of money with a higher interest rate and a shorter repayment period of 12 months. Alternatively, a long term loan can offer a larger amount of money and more flexibility when it comes to the repayment period.

Want to apply for a short term loan?

At Swoosh, we pride ourselves on being a responsible lender with easy online applications and no hidden fees! If a short term loan sounds right for you, apply with us today.