6 Ways to Improve Your Credit Score

Your credit rating is important if you ever want to take out a loan, credit card, or other financial agreement. Sadly, it’s easy to fall into a poor or bad credit rating because of a tough time in life. Especially when it comes to keeping up with repayments. This is why we have put together a blog about 6 ways to improve your credit score and help you bounce back faster.

Overview:

- How long does it take to improve your credit score?

- 6 ways to improve your credit score rating

- How long does bad credit last in Australia?

How long does it take to improve your credit score?

It could take anywhere from a few months to a few years to improve your credit score in Australia. The exact length of time will depend on what is bringing your score down and what steps you take to improve your score. We’ll break down how a credit score is calculated, why it is important to have a credit rating, and what steps you can take to improve your credit score over time.

6 ways to improve your credit score

If after learning “what is a good credit score”, you’ve now realised yours isn’t where you want it to be — you’re not alone. Improving your credit score takes time, but the sooner you address the issues that might be dragging it down, the faster your score will improve.

Here are a few ways you can improve your credit score quickly:

1. Pay your repayments on time

The first step to improving your credit score is to prevent any more missed payments from occurring. If you are having trouble meeting your repayment obligations, contact the lender or bank and try to work out a new payment plan.

You can also reach out to the National Debt Helpline for free advice.

2. Pay off your debt

Easier said than done, but it is helpful to keep your debt down. This includes keeping balances low on credit cards and other revolving credit, like Afterpay.

In some cases, it may be helpful to use a debt consolidation loan to roll repayments into one account. That way you only have to focus on paying off one debt and manage one repayment.

3. Apply for new credit only as needed

Keep in mind that each hard enquiry on a loan application shows up on your credit report and will cause a temporary dip in your credit score—even if you don’t end up taking out the loan. Avoid applying for loans in rapid succession as this can signal to lenders that you are in financial hardship.

4. Don’t close unused credit cards

Keeping unused credit cards open—as long as it makes sense for your situation and they’re not costing you money in annual fees—is a smart strategy, because closing an account may increase your credit utilisation ratio.

Simply put, a credit utilisation ratio is dividing the money you own on your credit cars by the total credit card limit. A good credit utilisation number is 30% or lower, this will increase your likeability with lenders and banks as they can easily see how up to date you are with repayments and overall money management.

5. Don’t apply for too much new credit

Too many enquiries can negatively impact your score, though this effect will fade over time. Hard enquiries remain on your credit report for 5 years. If you are unsure, check out our handy guide: How to Know if you are Ready to Reapply for a Cash Loan.

6. Dispute any inaccuracies on your credit reports

Incorrect information on your credit reports could drag your score down. Verify that the accounts listed on your reports are correct.

How long does bad credit last in Australia?

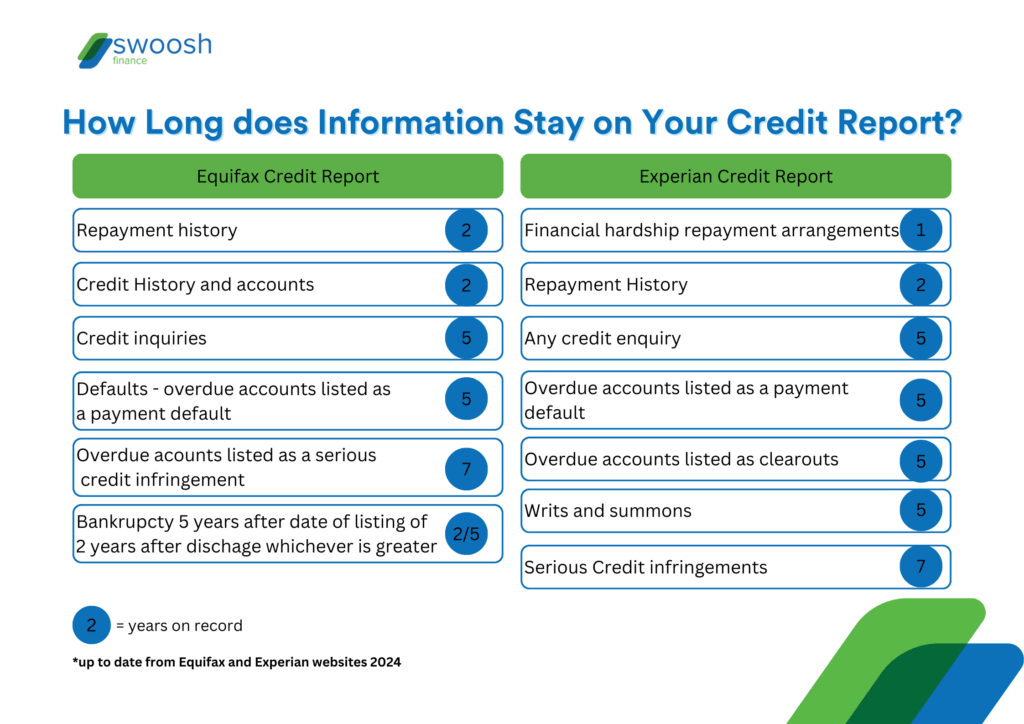

Information can stay on your credit report for up to 7 years. However, the most common factors that influence it, like repayments, will only remain for up to 2 years. It is best to start repairing your credit history as soon as possible so past mistakes won’t affect new finance you may be interested in acquiring in the future.

Thinking about consolidating your debt? Swoosh has you covered!

Do you now understand ways to improve your credit score and think a debt consolidation loan could work for you? Learn more about our debt consolidation loans and see if they can help you start to improve your credit score today. Apply now with our easy online application.