Secured vs Unsecured Loans — What’s the Difference & Which is Better?

Secured vs Unsecured Loans, what is the difference? If you’ve been wondering this, you’re not alone. When looking for loans, it’s good to start off with some research into the different loans that apply to you and your situation. Especially with secured and unsecured loans, it gets confusing to compare the two and see which one is the best choice for you. Luckily Swoosh has you covered. We’ve broken down everything you need to know about the difference between secured loans and unsecured loans, plus how to choose the right option for you.

Overview:

- What’s the difference between secured vs unsecured loans?

- Interest Rates and fees for secured vs unsecured loans

- Secured vs unsecured loan examples

- Pros and cons of secured and unsecured loans

- How to tell if your loan is secured or unsecured?

- Will a secured loan affect my credit score?

- What is better, a secured or unsecured loan?

- Is it better to have secured or unsecured debt?

What’s the difference between secured vs unsecured loans?

Secured loans use an asset, like a car, as collateral, which the lender can claim if the borrower defaults. Unsecured loans are based entirely on your creditworthiness, often requiring a higher credit score. The collateral on secured loans acts as insurance for the lender, allowing for easier approval and lower interest rates compared to unsecured loans.

What is the security of a loan?

Security for a loan, often referred to as collateral, is an asset promised by the borrower to protect the lender if loan obligations are not met. It ensures that if the borrower fails to repay the loan, the lender can seize the asset to recover the outstanding amount.

Examples of loan security:

- Real estate

- Vehicles

- Equipment and machinery

- Jewellery and valuables

- Recreational vehicles

Interest rates and fees for secured vs unsecured loans

Your loan will have different terms and interest rates depending on several factors, including your chosen lender. Whether or not your loan is secured or unsecured is also a big factor in calculating the interest rates on your loan.

Do secured loans or unsecured loans have higher interest rates?

Unsecured loans typically have higher interest rates because they involve more risk for the lender. If you miss payments and default on an unsecured loan, there is no asset that the lender can repossess to recuperate their lost finances. However, even though they won’t be able to take any of your assets, you are still financially liable.

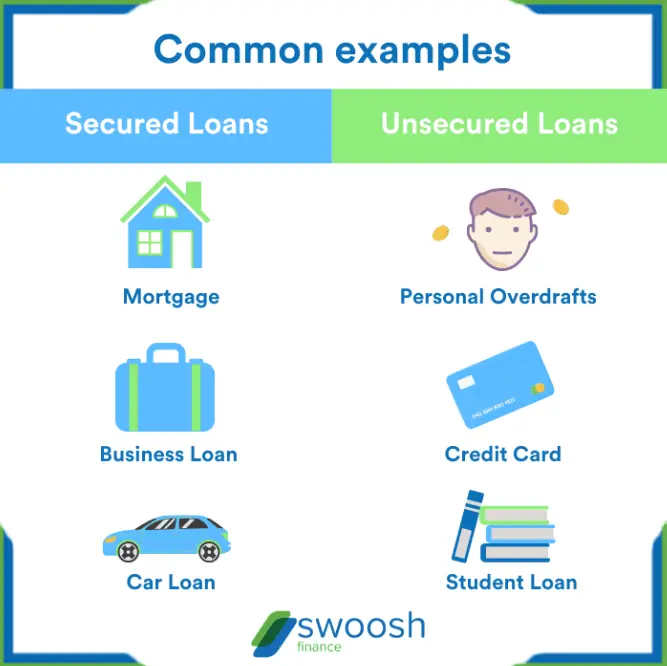

Secured vs Unsecured loan examples

Common examples of types of secured loans:

- Home loan/mortgage

- Business Loan

- Car loan

- Secured personal loan

Common examples of types of unsecured loans:

- Personal overdraft

- Credit card

- Student loan

- Unsecured personal loan

Pros and cons of secured vs unsecured loans

It’s important to weigh the benefits and downsides of secured and unsecured loans before choosing the best option for you.

Advantages of secured and unsecured loans

| Advantage of secured loans | Advantage of unsecured loans |

|---|---|

| Access cash quickly—sometimes even on the same day. | No physical assets are needed as security. |

| Usually a lower interest rate compared to unsecured loans. | Can have a faster approval process. |

| Typically able to borrow larger amounts. | Flexible repayment options. |

Disadvantages of secured and unsecured loans

| Disadvantages of secured loans | Disadvantages of unsecured loans |

|---|---|

| The asset used as security can be seized if repayment obligations are not met. | Typically higher interest rates due to increased risk for the lender. |

| Typically involves a longer approval process. | Harder to get approved and more strict lending requirements. |

| Usually have longer repayment terms, so can cost more in interest. | Typically lower borrowing limits. |

| Defaulting negatively affects your credit score. | Defaulting negatively affects your credit score. |

How to tell if your loan is secured or unsecured

You have a secured loan if it involves collateral, like a loan against your car. If your loan does not involve collateral and relies only on your agreement to pay back the loan (plus interest and any additional fees) then it is an unsecured loan.

How compensation for a defaulted loan impacts interest rates

For unsecured loans, the lender will need to take legal action to seek compensation, which could end up costing you more in the end. Because, if the judge sides with the lender you will also need to cover the cost of their legal fees.

For secured loans, the compensation process is more straightforward as the lender can seize the asset listed as security. This is why secured loans tend to have lower interest rates.

Will a secured loan affect my credit score?

A secured loan will affect your credit score in the same way as an unsecured loan. If you fail to make repayments and default on your loan your credit score will be negatively affected.

What is better, a secured or unsecured loan?

Which loan type is better for you will depend on your particular circumstances. Considering secured loans generally have lower interest rates, they are a great option if you have assets to use as collateral. On the other hand, an unsecured loan may be the best choice if you don’t have any assets or don’t want to place them at risk.

Is it better to have secured or unsecured debt?

If you default on a secured loan the lender can repossess the assets listed as security on the loan. If the asset does not fully cover the cost of your debt, the lender may also take legal action. With unsecured debt, the only way for a creditor to recuperate their lost funds is through legal action, which could cost you more due to legal fees.

Need a secured personal loan?

Try our Loan Calculator to see what your repayments would be with a small secured personal loan from Swoosh Finance. You can apply for up to $5,000 today with fast approval.

Got any questions? Contact us to speak to one of our friendly loan experts.