Medicare vs Private Health Insurance

In Australia, we’re very fortunate to have access to a public healthcare system, aka Medicare. It may surprise you to find that Medicare almost didn’t happen. In 1976 the new government dismantled Medibank (Medicare’s predecessor) leading to Australia’s first (and so far only) nationwide strike. It’s because of this national action that we all get to enjoy free universal healthcare today. However, there are still certain things Medicare doesn’t cover that can lead to out-of-pocket expenses for you—maybe even needing you to take out a small emergency loan.

So, is it worth investing in private health insurance to cover the gaps? It ultimately depends on your circumstances. To help, we’ve broken down the advantages and disadvantages of Medicare vs private health insurance for you. Keep reading to learn more.

Overview:

- What is the difference between Medicare & private health insurance

- Do you need Medicare if you have private health insurance?

- What is Medicare?

- What is private health insurance?

- Medicare vs private health insurance: pros & cons

- Is private health insurance worth it?

- Is Medicare or private insurance better?

What is the difference between Medicare and private health insurance?

Medicare is paid for by your taxes and covers treatment and medicine offered in the public health system. Private health insurance is optional, and you have to pay for it out of pocket to be treated in the private healthcare system.

Other key differences include:

- How you pay for treatments

- The waiting periods for treatment

- Where and which doctor/hospital you get treated at

- What you pay in tax each year

We’ll get into the differences between Medicare vs private health insurance more detail below.

Do you need Medicare if you have private health insurance?

Yes, Medicare is a national insurance scheme and is needed to access public health services. It covers things (such as the cost of seeing a GP) that private health insurance does not. You can have a combination of both Medicare and private health insurance.

What is Medicare?

Medicare is a universal health insurance scheme provided by the Australian government to cover a range of health services and medicines. It is available to Australian citizens and most permanent residents. It funds the public health system through the Medicare levy, paid when you submit your tax return each year.

Medicare’s free or subsidised costs mean Australia has some of the most affordable and accessible medical services in the world (excluding dental).

What does Medicare cover?

The following is covered by Medicare:

- Part of the cost of seeing a GP or specialist*

- Most prescription medicines

- Free treatment and accommodation in public hospitals. (As a public patient in a public hospital, you’ll be treated by hospital-appointed doctors and subject to waitlists for non-emergency treatment.)

*You may have to pay a portion of the cost out of pocket (or with private health insurance) if the specialist charges more than the Medical Benefits Schedule (MBS) fee.

What does Medicare not cover?

When considering Medicare vs private health insurance, you must consider what Medicare doesn’t cover, which includes:

- Dental

- Ambulance services*

- Optometry, including the cost of glasses/contact lenses

- Hearing aids

- Therapies such as speech physiotherapy, pathology, osteopathy and remedial massage.

- Elective surgery

- Cosmetic surgery

This is where private health insurance can fill the gaps and give you more choice over treatment.

*If you are a resident of Queensland or Tasmania you don’t have to pay ambulance costs as it’s covered by your taxes.

What is private health insurance?

As the name suggests, having private health care allows you to access the private health system. Private health insurance can be purchased from a registered health insurer and you will pay regular premiums to maintain your cover.

What does private health insurance cover in Australia?

There are many different levels of cover to choose from, and it can include things like:

- Hospital cover

- Extras cover (such as dental, physiotherapy or optical)

- Ambulance cover

What does private health insurance not cover?

There are some things that are not covered by private health that are covered by Medicare, including:

- GP visits

- Out-of-hospital medical services that are covered by Medicare

- The bulk of the cost associated with consultations with specialists

- Out-of-hospital diagnostic imaging and tests

- Some natural therapies.

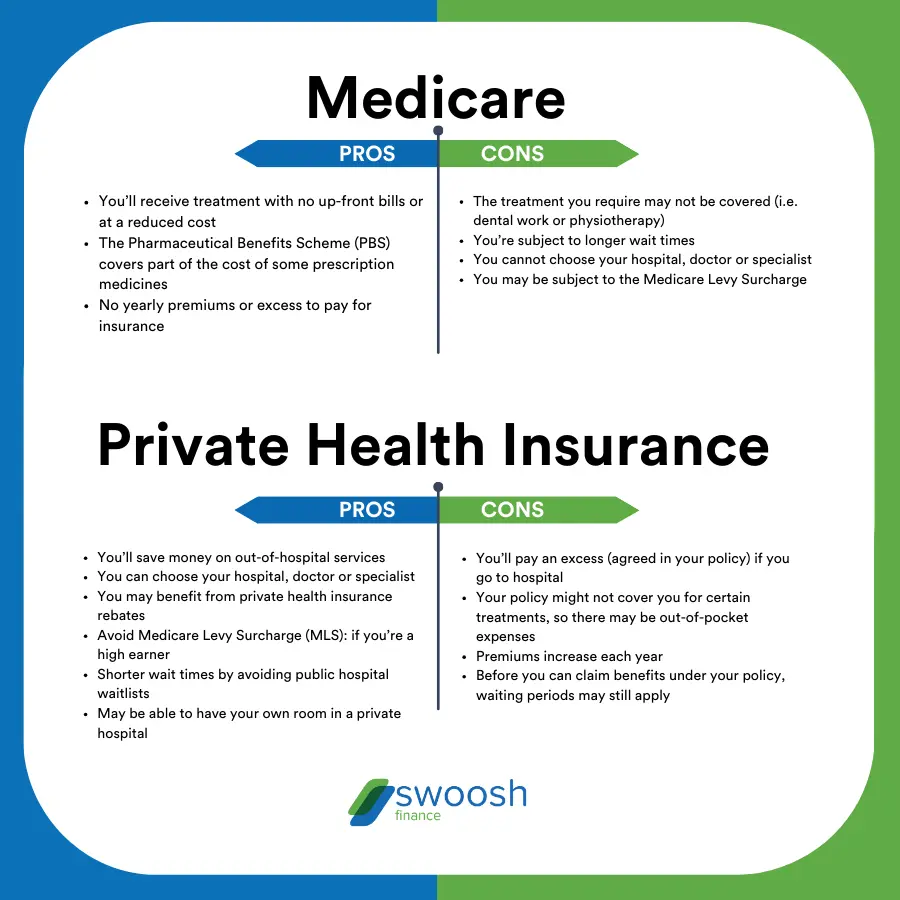

Medicare vs private health insurance: pros & cons

While private health insurance has many benefits, it can be pricey so you do need to weigh up the pros and cons of it. To help you compare private and public healthcare we’ve summarised the main pros and cons of Medicare vs private health insurance.

Main advantages of Medicare Australia:

- Treatment at no upfront cost (or a reduced cost)

- No insurance premiums or excess

Main disadvantages of Medicare Australia:

- Some treatments aren’t covered

- Longer wait times & less choice

Main advantages of private health insurance in Australia:

- Shorter wait times & more choice

- Money saved on out-of-hospital services

Main disadvantages of private health insurance in Australia:

- Must pay an excess when you claim

- Some treatments may not be covered depending on your policy

- Can be expensive

Is private health insurance worth it?

It depends on the type of health insurance you get and exactly how accident-prone you are. One of the common frustrations of private health insurance is paying large amounts only to find out your insurance policy doesn’t cover the work you need.

On the other hand, paying hefty up-front costs out of pocket isn’t realistic for most of us. Health insurance can make it easier to bear this burden in the event of a medical crisis. Private health insurance can also help you avoid long wait times for elective surgeries.

So private health insurance can be worth it if you have significant medical and dental costs that it will cover. But sometimes you might find it’s more cost-effective to simply open a savings account to use in emergencies instead.

Is Medicare or private insurance better?

Now you’ve learned about the advantages and disadvantages of Medicare and private health insurance, you have to decide which one suits you!

How? It’s a simple cost-benefit analysis. If you are generally in good health then health insurance may be a waste of money. You could instead put aside the money you would spend on a premium for emergency expenses—or trust the public system to take care of you. If you have regular medical expenses or a chronic health problem, then private health cover could save you money and time.

If you are looking for an easy way to compare plans, comparison sites like Compare the Market can be a good place to start. They compare dozens of companies at different levels of cover. But be aware they don’t necessarily have everything listed.

Should you have additional unexpected medical expenses that you don’t have the cash for, we can help. Find out how to apply for a payday loan online and then apply for a cash loan in a few easy steps!