Money Management Apps

Do you get halfway through the month and wonder where all of your money has gone? If you’re looking for better ways to manage your money, then a money management app may be the solution you need. There’s a lot of choices out there when it comes to money management apps so we’ve put together a list of the 10 most commonly used. We’ve broken down their costs, availability, and their best features so you can make an informed decision about what’s right for you. With the right money management strategy, you could build your savings and achieve your financial goals – without the need for a small loan!

Overview:

Budgeting Apps

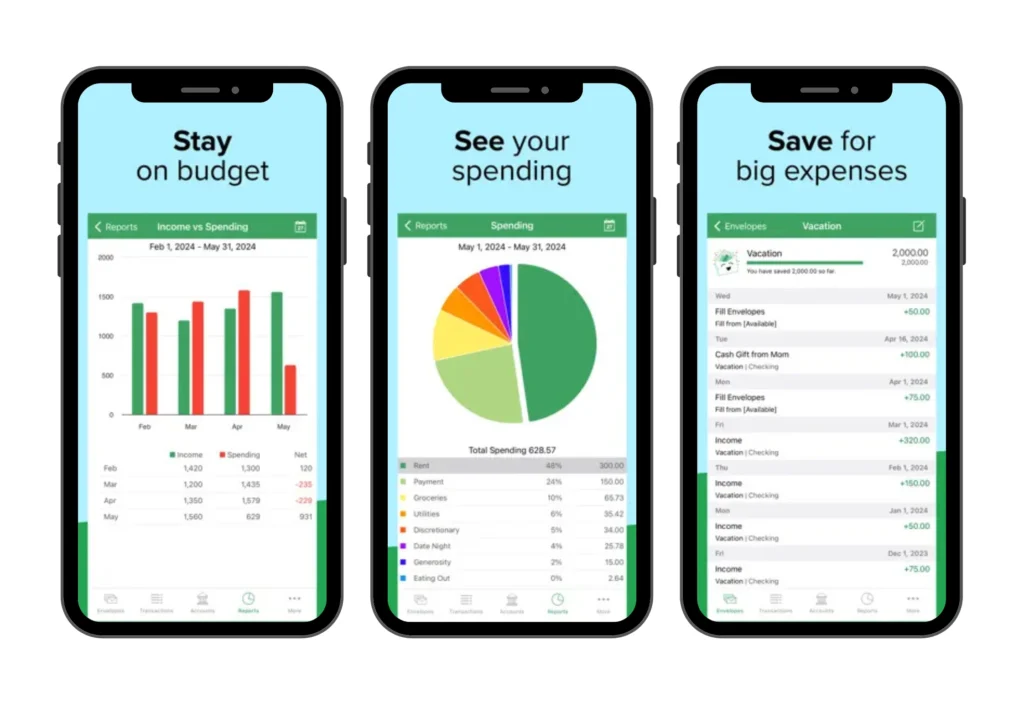

Good Budget

Best feature: Uses the age-old “envelope” budgeting system

We love: Good for people with varying expenses

We don’t love: Features are limited unless using premium

Availability: iOS, Android, Web

Cost: free or $9.99 month premium plan / $79.99 yearly premium plan

Similar to other money management apps, the Good Budget can track expenses, monitor savings goals, sync with your partner, monitor cash flow and analyse spending patterns. The main difference is this app uses a virtual version of the old-fashioned envelope system to help you budget your money. The envelope system is a type of budget that involves putting cash in envelopes for specific purposes. It can be great for people who have varying expenses week to week.

While this app isn’t Australia specific, Australians can still use it. Find out more here.

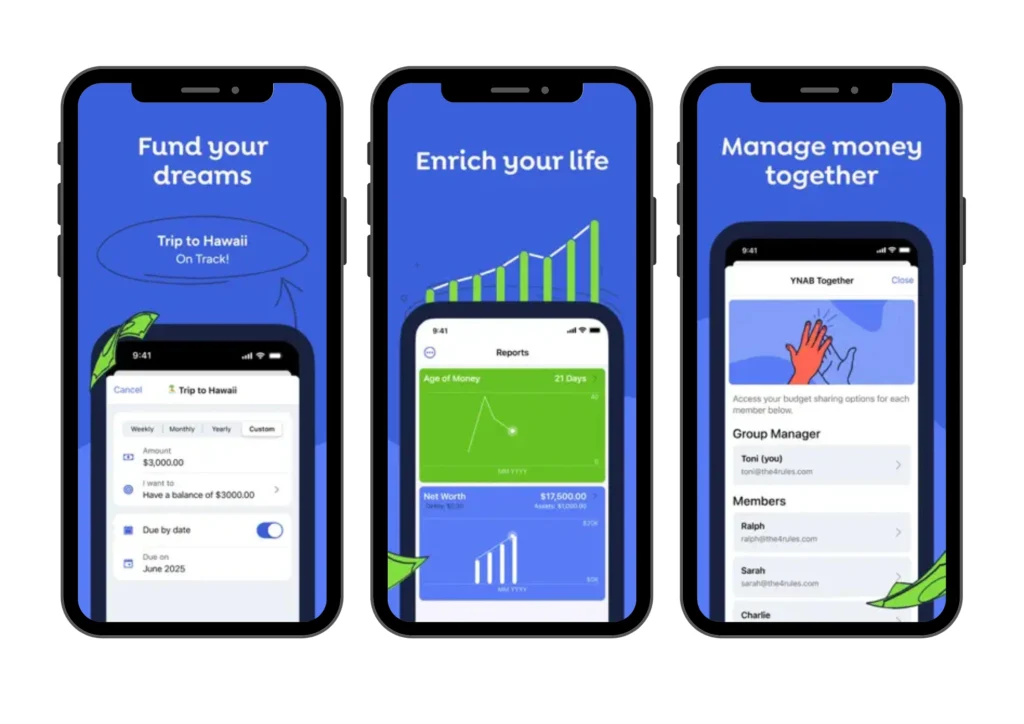

YNAB

Best feature: Utilises the “zero sum” budget strategy to make your money work

We love: Extremely powerful budgeting tool

We don’t love: Offers similar functionality to other apps that are free

Availability: iOS, Android, Web

Cost: $14.99 month premium

YNAB on the surface looks very similar to other budgeting apps. The reason it made our list is because of the benefits having a paywall offers. Synchronisation is a lot smoother than other apps and most importantly (to some users) — they won’t sell your data to third parties. This may be worth the premium costs for those who are concerned about their data. Their customer service is also reported to be much better.

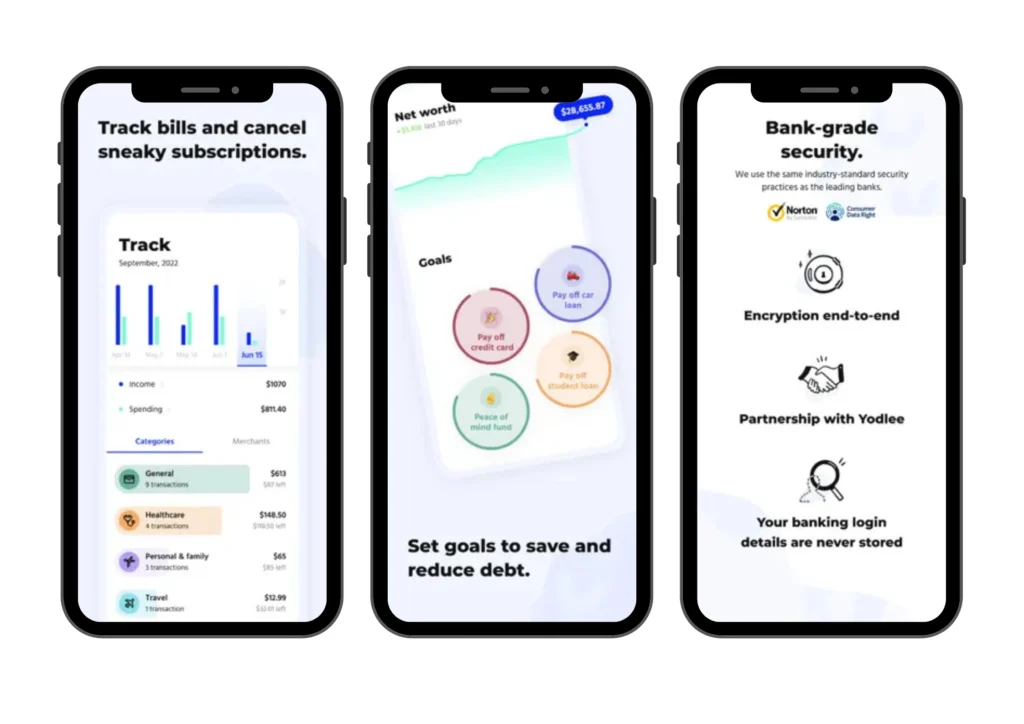

WeMoney

Best feature: Connects all your bank accounts and credit cards into one space

We love: Updates all your bank details and expenses quickly

We don’t love: Limited categories on the free version

Availability: iOS, Android, Web

Cost: Free or $9.99 month premium / $98.99 yearly premium

WeMoney is a great budget app that connects all your bank accounts and credit cards into one app. Allowing you to see all transactions at once, generating personalised savings options to free up debt and shares monthly credit score updates. This app has everything needed to work on budgeting, repaying debts and being able to categorise transactions for different uses. The goal in mind was to improve users’ financial performance and usability with the added bonus of being linked to a passionate financial community to help you reach your financial goals.

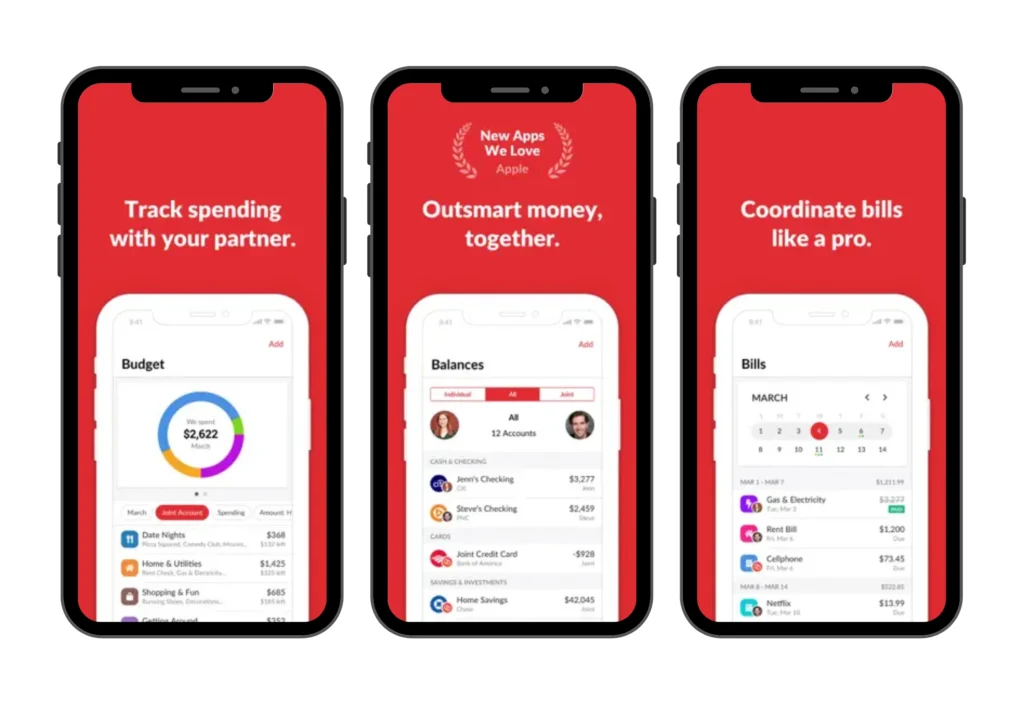

Honeydue

Best feature: Developed for couples to sync each other’s finances to see it all in one place

We love: Many automated systems so you can see your expenses in the categories

We don’t love: Focuses more on learning about past transactions rather than planning ahead

Availability: iOS, Android, Web

Cost: Free with additional costs for more access

Unlike other money management apps, Honeydue’s main purpose is to help couples coordinate their spending, and help them manage their finances and bills together.For how many functions these apps offer, it’s free to use the majority of functions. Honeydue allowscouples to set limits on certain budgets each month and notifies you when you are close to the limit. This app is beneficial for all couples to stay financially stable, especially when saving up for a holiday, car, mortgage or to start a family.

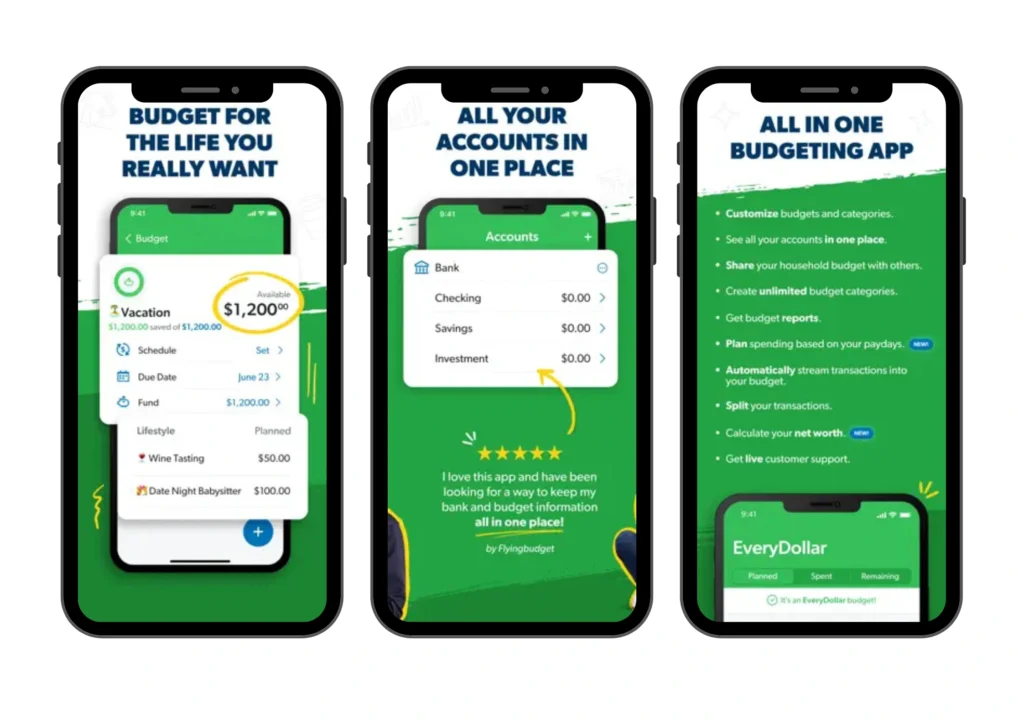

EveryDollar

Best feature: Offers simply zero-based budgeting

We love: Simplified and allows you to manually enter your spendings and use it in your own way

We don’t love: Free version is very bare while the premium can seem pricey

Availability: iOS, Web

Cost: Free or $17.99 month premium

EveryDollar is essentially the simplified version of YNAB, allowing you to keep track of your payments, bills and subscriptions. Like many other apps, you can connect it automatically with your bank accounts with the premium plan. EveryDollar is favoured by its uses for the simplicity and the straightforward uses of each section on the app.

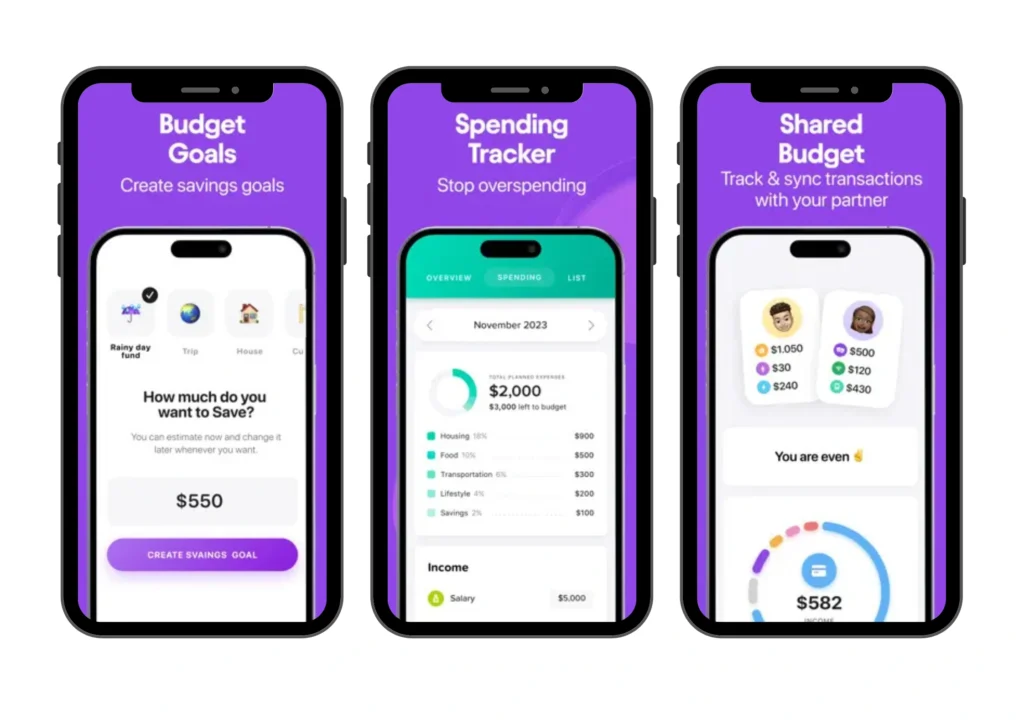

Buddy

Best feature: Sync all your accounts into one place

We love: Fully customisable to what you want your finances to look like

We don’t love: Still needs a function to sync to Australian bank accounts

Availability: iOS

Cost: Free or $14.49 month premium / $72.99 yearly premium

Buddy is a great tool to use, generating great saving results from all its users. It’s also great for when you’re wanting a personalised feel to the app and the ability to create a personalised budget. This app allows you to track your spendings separately or invite family, partners or roommates to join and work together to save up. Sharing transaction details and breakdowns of different areas that you could cut back on is also very useful. This would also be a simple money management app for beginners as it allows for customisation and personalised feedback about your finances and spending habits.

Investing Apps

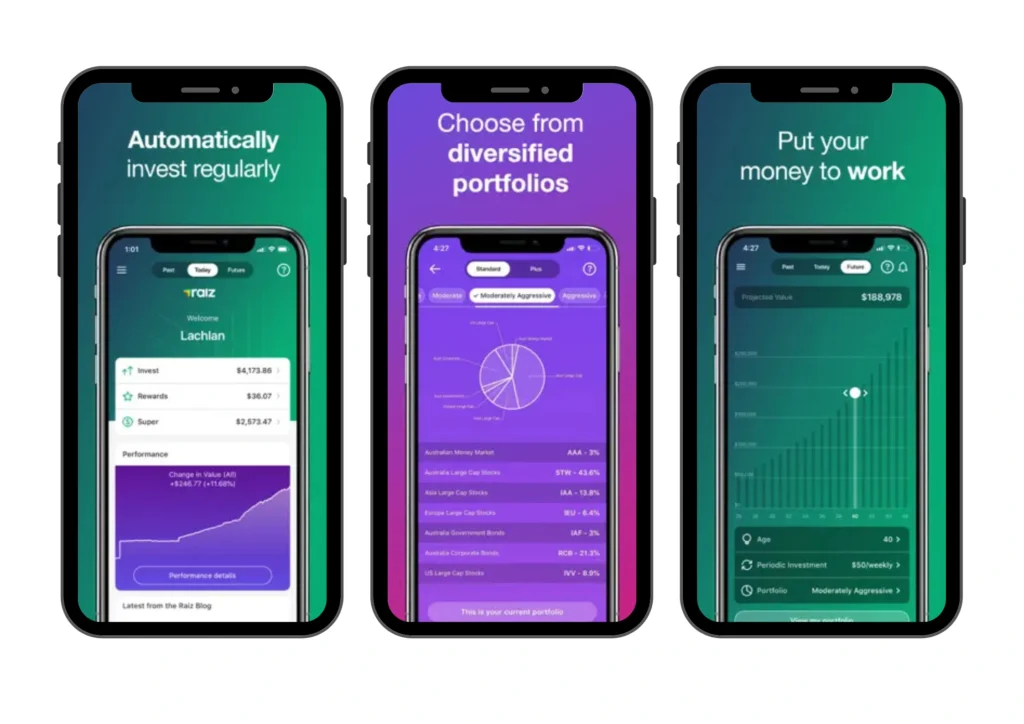

Raiz

Best Feature: Set and forget investing

We love: The emerald portfolio featuring ethical investment choices

We don’t love: Information on composition of share packages is not readily available

Availability: iOS, Android, Web

Cost: $4.50 per month

Raiz is an app that allows users to buy shares using small amounts of money called micro-investments. It works by rounding up your transactions to the nearest dollar and using the extra change to make small purchases in the stock market. You can also set recurring amounts to invest daily, weekly or monthly.

The app includes a range of investment options from Conservative to aggressive – similar to a superannuation fund. It’s a great choice for people wanting to get started with the sharemarket but don’t want to take a big risk or don’t know where to get started.

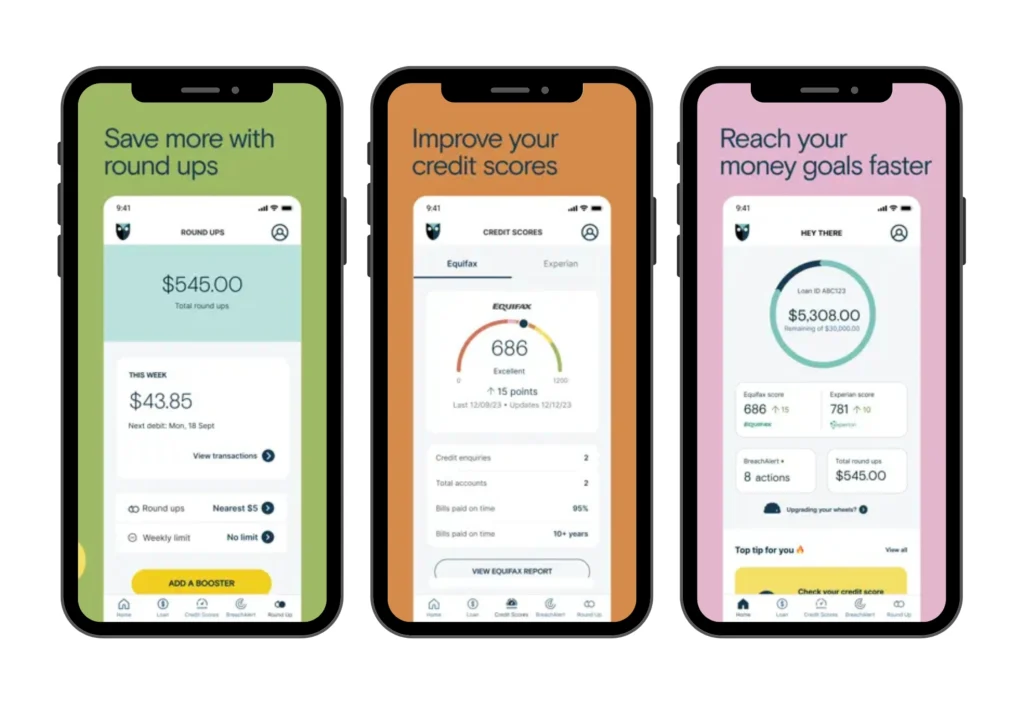

Wisr

Best Feature: Uses microtransactions to pay off debt faster

We love: Can pay off debt without the user noticing

We don’t love: App may be used to offer personal loans

Availability: iOS, Android, Web

Cost: Free

Wisr is an app to help you pay off your debt faster. It operates using the same method as Raiz – rounding up your transactions. But instead of investing the extra money, it uses the funds to pay off your debt. It can be used to pay down credit cards and mortgages, with the possibility of others.

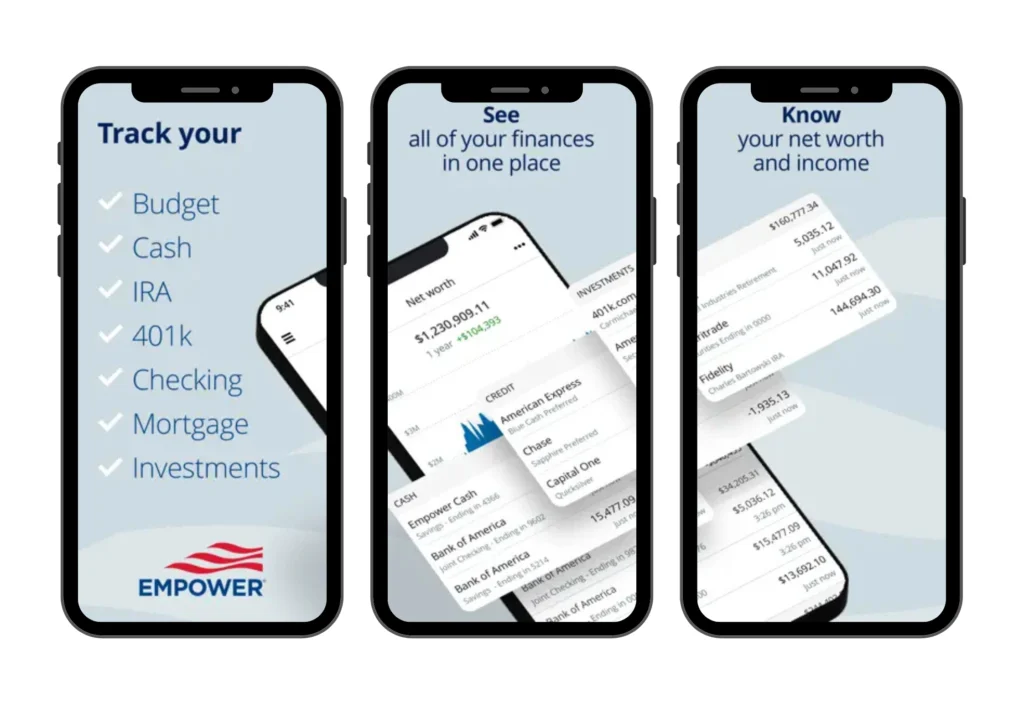

Empower Personal Dashboard

Best feature: Focus on investing

We love: Clean layout shows a clear picture of financial position

We don’t love: High fees for wealth management services

Availability: iOS, Android, Web

Cost: Free with premium features if desired

Empower Personal Dashboard focuses more on investment strategies and maximising the growth of your net worth. If you have multiple accounts and loans it is a great tool to show your liabilities decreasing and your assets increasing. Empower Personal Dashboard has some budgeting tools but the investment portion of that app makes it unique and the reason it made it onto our list.

Pearler

Best feature: Invest in small amounts to build financial security

We love: Set and forget method when it comes to investing

We don’t love: Transaction costs when buying and selling shares

Availability: iOS, Android, Web

Cost: Free with transactions fees

Pearler is a great tool, especially for beginner investors, allowing you to set up investments and make money overnight. Build up your network and learn from others in the investment community to build your own knowledge of what you are doing. Pearler is a great way to start if you want to learn how to invest and potentially build up another income stream.

Which app is right for you?

Whether you’re looking for a better way to budget or you’re thinking of breaking into the investment space, it’s important to consider your choice of app carefully. All the apps in our list have different functions, unique accessories and different prices, however deciding which one is right for you will ultimately depend on your individual circumstances and financial goals.

A great way to see which app has the best feel and functionality is to try out the free versions of the apps. Test the free versions of the apps for a few weeks at a time and then decide which one to stick with and/or upgrade to the premium version. Testing the apps for a few weeks will help you make an informed decision about what’s right for you!

Want to kick start your budget app with some extra money? Swoosh has you covered!

If you want some help to kick start your plan to budget with some extra cash, then apply for a small loan with Swoosh! Apply today for loans with a simple, 100% online application process and no hidden fees.