How to Get a Loan Against a Car

When looking at options to take out a loan, it is important to research the different loan types and what different lenders provide, based on their eligibility criteria, interest rates and borrowing amount. This blog will help share more information about secured loans and how to get a loan against a car.

Overview:

- What does finance against a car mean?

- Steps to getting a loan against your car

- Can you get a loan against a car and still drive?

- Loan against an already owned car

- How much can you borrow from a secured loan?

- What is the interest rate for a secured loan?

- Are secured loans easier to get?

- Who is eligible for a loan against a car?

What does finance against a car mean?

When someone is talking about finance against their car, they are talking about having a secured loan that uses their car as collateral. Having a secured loan with collateral allows you and the lender to have leverage so if something goes wrong or you do not make the repayments, the lender may take the car to accumulate the rest of the money owed.

Steps to getting a loan against your car

The exact process will depend on which leader you choose to proceed with. Generally speaking, here at the 5 steps of getting a loan against your car:

- Research and choose a lender – there are many lenders in Australia who do loans against cars, it is your decision of which one you go with.

- Check eligibility – different lenders may have different criteria required to work with them.

- Complete loan application with documents – most days most banks and lenders offer an online application.

- Follow up on any additional documents or information if needed – it’s important to share everything the application asks for and this will allow you to get your loan quicker.

- Sign documents – once your application has been approved, you will receive a document to sign saying you have agreed to the loan repayments and all the terms and conditions.

- After this you will receive your loan and will shortly begin the repayment process.

Can you get a loan against a car and still drive?

Check with your lender first, before you decide to use your car as collateral for the loans as some lenders may have different terms and conditions. Swoosh allows you to get a loan and still drive your car while the loan is active and you are following up with the repayments.

Loan against an already owned car

It is possible to get a secured loan against a car you already own. Generally, lenders will assess the car’s value to determine if you are eligible and how much you can borrow. With Swoosh you can apply for a small loan against your vehicle (that is registered under your name), so you can get access to some extra cash when you need it.

How much can you borrow from a secured loan?

How much you can borrow will depend on which lender you choose, what your car is valued at, and your financial situation.

Swoosh offers loans against cars from $2,200 to $5,000.

Can you pay a secured loan off early?

You can pay off a secured personal loan early but depending on the lender and fees set out in your loan agreement, there may be additional fees you will need to pay. Swoosh Finance does not charge any early repayment fee, so you can pay your loan off at any time without any extra costs.

Can you get a loan against a car with no credit check?

Most responsible Australian lenders will perform a credit check as part of their assessment process. While it is possible to get a loan without a credit check, these loans are usually for small amounts and come with high interest rates.

Swoosh does not offer no credit checks loans however, we do provide loans for bad credit history. We look at your current financial situation to see if you meet our affordability criteria.

What is the interest rate for a secured loan?

Interest rates vary depending on the lender but are generally lower than unsecured loans due to the collateral attached to the loan.

Interest for Swoosh secured loans is calculated daily based on the outstanding balance. Our payday loan rates and fees always include the interest rates that are fixed for the loan term — so you know exactly what to expect. If a scheduled payment is missed or returned unpaid, we may issue a $39.95 debit dishonour fee.

- Annual Interest – 47% (Comparison Rate 66.0347%)**

- Interest rates are fixed for the loan term and are based on the outstanding balance.

- By dividing the annual interest rate by 365, the daily interest rate is determined.

- Comparison rates vary from 65-66% depending on the size of the loan

If a scheduled payment is missed or returned unpaid, we may issue a $39.95 debit dishonour fee. This may affect the length of your loan and therefore change your payday loan cost.

Are secured loans easier to get?

Typically secured loans are easier to get than unsecured loans. This is because using your car as collateral reduces the risk for the lender if you fail to make repayments and default on your loan.

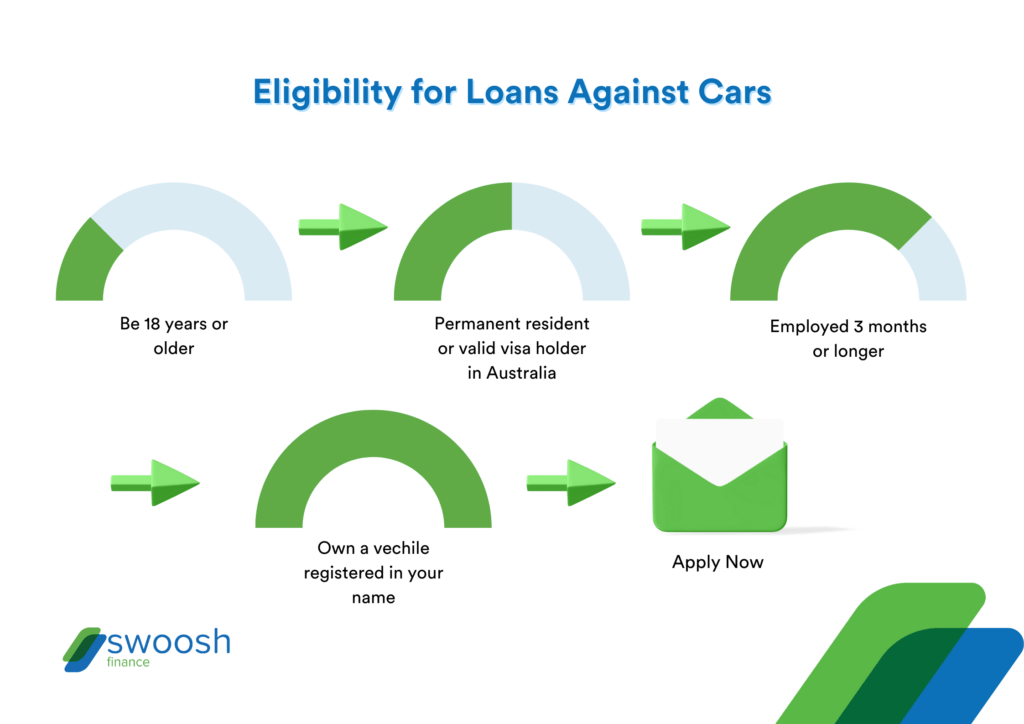

Who is eligible for a loan against a car?

All lenders have different terms, conditions, and eligibility requirements when it comes to their loans and lending processes. Swoosh keeps things simple with just 4 criteria for you to be able to apply for a loan:

Think a loan against your car is the way to go? Swoosh has you covered!

Hopefully this blog has answered some of your questions when it comes to getting a loan against a car. If you want to ask more questions about loans against cars, our friendly team is always happy to help.

Need to get cashed up ASAP?? With our 100% online application process, it’s quick and easy to apply today and get the ball rolling.